Foreign education can be very expensive, students are constantly concerned about how to pay for their tuition and their living expenses. Thousands of international students come to Canada and do not know how to stretch the dollar. In order to stay afloat in Canada, it is important to know how to budget, save and explore ways to earn additional income. This financial guide for international students in Canada will allow you to keep your expenses under control and stay away from debt. If you are a new immigrant in Canada, learn about getting your finances together in this post.

How to budget as an international student in Canada

Monitor & track all your expenses

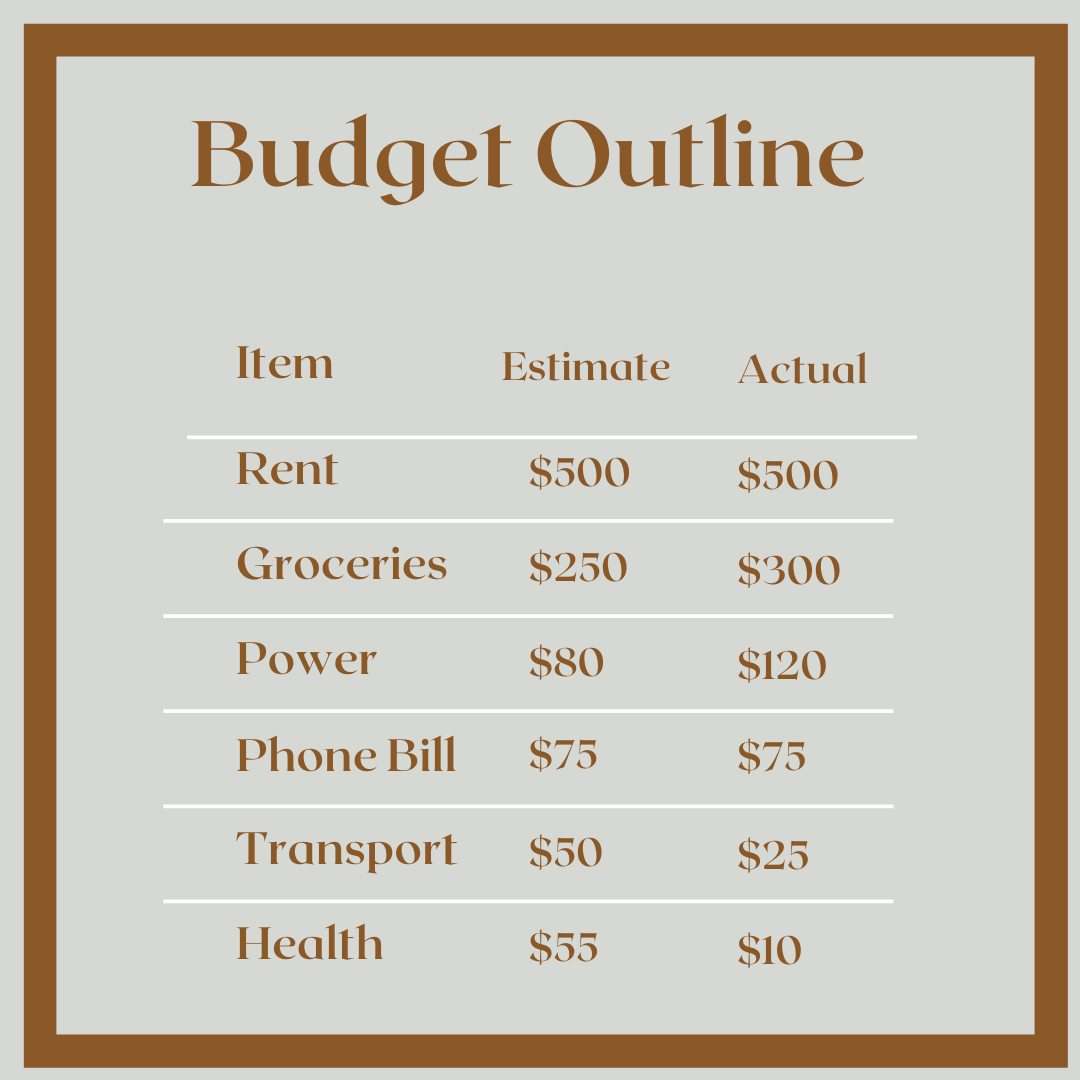

Write all your recurring expenses and put the cost of each of the items next to it over a month period. This gives you a clear idea of what your monthly expense looks like. Here is an example below:

Once you have this number down, you can begin to track your estimated vs actual expense on an excel file. This budget outline gives you an overview of where to cut costs. If you want your expenses to be tracked automatically use Mint. Pocket Expense is also a great tool for tracking your expenses.

How To Save Money As An International Student In Canada

Get a Student Price Card (SPC)

The SPC Card entitles students to discounts ranging from 10% to 50% off on a variety of brands. If you open a bank account with CIBC as a student, you will receive SPC cards for free.

Put Money Aside For Emergency

The truth is that no matter how much money you make, it will always feel like you do not have enough. It is best to start cultivating the habit of saving as a student so it is easier when you start working full time. You can utilize all of the cost-cutting techniques, if you do not put money aside it will never seem like you were saving anything. Ensure you put all of the money you save into a separate account (out of sight, out of mind). You can put your money into a high-interest savings account, such as one offered by EQ Bank.

How does putting money aside work?

Scenario: You put aside $20 per month from your paycheque or money you receive from family for a year and have $480 plus to go toward tuition at the end of the year.

Discounts & Coupons

Students receive a 10% discount at a number of retailers including Lawton’s Drug and Atlantic Superstore. Show your student ID and inquire if the store you’re shopping from has a student discount. Furthermore, some stores provide student discounts on specific days.

When it comes to coupons, I’ve found that shopping online usually yields the best results. Honey can also save you money if you have it installed as a browser plugin.

Food Banks

Universities and non-profit groups run food banks to assist students and low-income earners who are having financial issues. Food banks may have food, hygiene products etc . Depending on the food bank you choose, they may or may not have everything you need, but they will surely help you.

How To Earn Money As An International Student In Canada

Open A High-Interest Savings Account

Tangerine and EQ Bank are two banks that provide high-interest savings accounts. This means that whatever funds you deposit into this account will earn interest. You can easily open an account by filling out an online form. These banks offer so many perks which include no monthly fees after you’re no longer a student. The only downside of these banks is that, unlike traditional banks, they do not have a physical location.

Cashbacks With Your Credit Card

There are tonnes of reward systems that you can take advantage of, especially when it comes to using your credit card. Choose a credit card that allows you to earn points to splurge on your interests. Here are a few examples of how to take advantage of the credit card you use

- If you love to watch movies, Scotia bank allows you to get points on your cinema card for every film ticket purchase you make with your bank card.

- RBC offers multiple types of credit cards that can allow you to earn points to spend on flight tickets, gas, shopping at your favourite store etc.

A credit card can get you in debt if you do not use it wisely so be sure you are using it responsibly.

Get A Part-Time Job

Working part-time while a student is one of the quickest methods to earn money while in school. International students are allowed to work only 20 hours per week.

Start A Side Hustle

You can have different side hustles such as social media manager, survey participant, craft seller, online English teacher, and so on. Juggling a side hustle with a part-time job and school can become stressful.

Enrol In A Coop Program

Coop programs allow you to work full time as an international student which allows you to earn significantly more than what a part-time job will pay you. Being enrolled in a Co-op program changed my finances as a student & I was able to save a great deal of money.

Conclusion

Being disciplined and consistent in your budgeting, saving, and looking for methods to grow your income will help you get your finances in order as a student. If you want to learn more about finance in Canada, visit Reni the Resource

post a comment

You must be logged in to post a comment.