Accountancy is a regulated profession just like a career in Law or Medicine . A career in accountancy with a CPA qualification takes about 6 to 7 years and as an immigrant that may take longer that you may consider if it is worth. This post features Open Diary sharing on how to become an accountant in Canada with CPA qualification in less than 2 years.

Introduce yourself

I like to refer to myself as a triple-qualified accountant because I hold certifications from the Institute of Chartered Accountants of Nigeria (ICAN) in Nigeria, the Chartered Institute of Management Accountants (CIMA) in the UK, and the Chartered Professional Accountants of Canada (CPA).

I studied accounting at Obafemi Awolowo University, Ile-Ife. After university, I immediately registered for ICAN and I qualified as an accountant in Nigeria in 2014. It was the greatest feeling ever acing the almighty exam. Fast forward to 2019 I got a provincial nomination from the province of Nova scotia and I landed in 2020, Right now I live in Ottawa. I decided to document my relocation journey and this gave birth to my Instagram page https://www.instagram.com/myopendiaryca/

Share your journey of being an Accountant being triple qualified in Nigeria, UK & now Canada

Before relocating to Canada in 2020, I did research on accountancy qualifications and the time it would take to become a CPA there because I knew I had to go through the CPA process. During my research, I learned about CIMA’s agreement with CPA which stated CIMA qualified accountant can apply to get a CPA. After carefully weighing my options, I decided to go the CIMA route. I quickly signed up for the 2020 CIMA Exam, and because to my ICAN, I was fortunate to receive exemptions. I only had to do the final exam, a strategic case study, which I passed in one sitting.

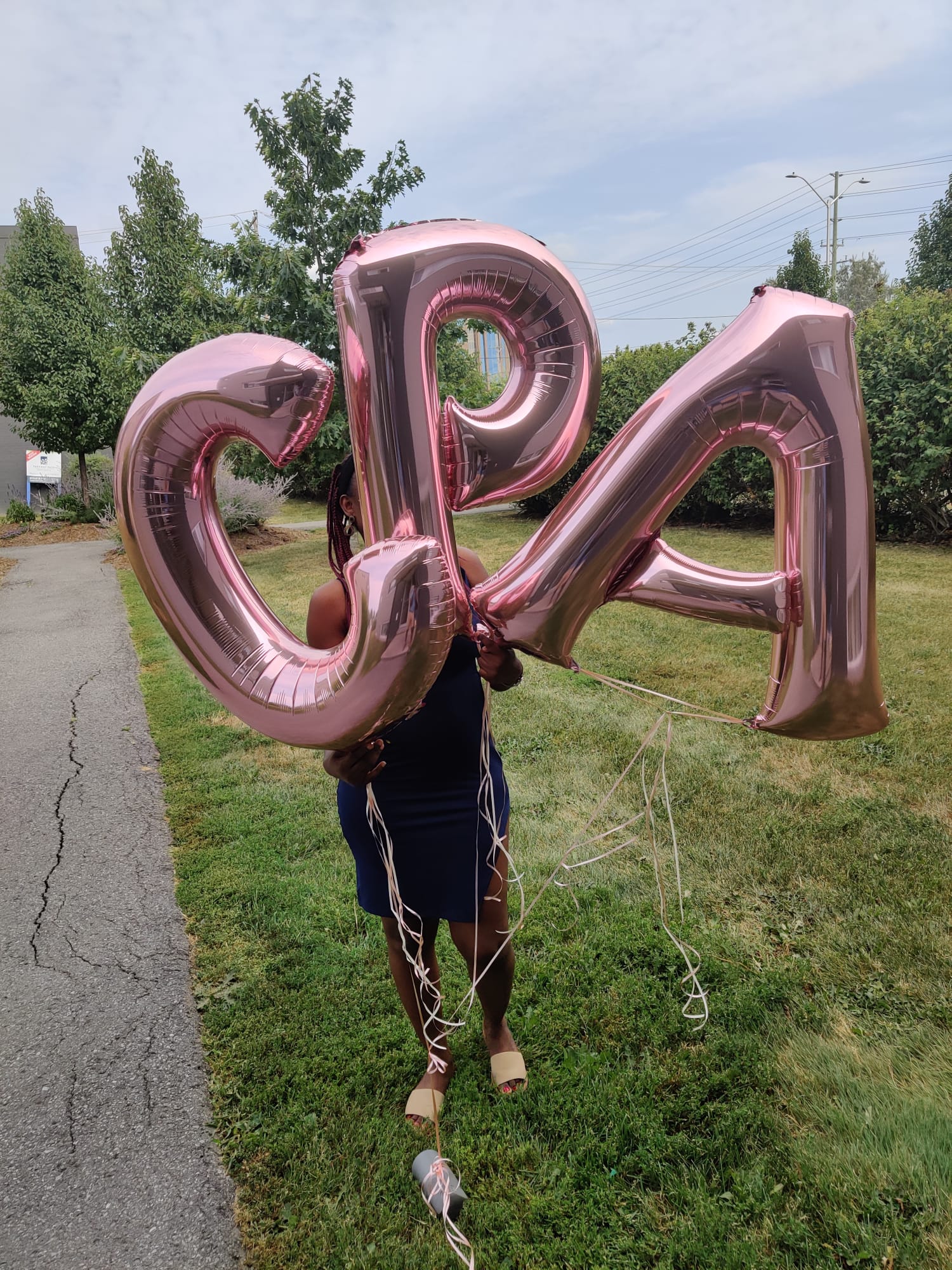

I sent my documents to the CPA in 2020 so they could validate my experience, university grade, CIMA reference, and all of the places I had worked. I had to prove I had all the necessary depth and breadth of skills, such as financial reporting, strategic management, tax, audit, and so on. The process took 9 months due to COVID but I eventually received my CPA qualification in August 2021.

It was indeed a fulfilling experience as the agreement ended July 15th, 2021 and now anyone with CIMA has to write CPA exams. That’s is why I believe make hay will the sun shines as you do not know when policies can change.

What are the steps required for one to take in order to qualify as an accountant in Canada?

Firstly, I would like to say CPA is not just about writing exams. It is an Academic journey that requires you go through modules and learning which end in an examination you must pass to proceed to the next module. You must also fulfill the 30 months of prescribed practical experience you can get this along the way. With ICAN, CIMA, ACCA or some other qualification on CPA website, you would need to complete the

- challenge the examinations of Core 1 and Core 2 Modules

- challenge the examinations of two Elective Modules

- Capstone 1 Module

- Capstone 2 Module

- Common Final Examination

Bear in the mind you must be either residing in, moving to or in the process of immigrating to Canada. Must have a university degree and minimum of 3 years relevant experience to begin the process.

How did you prepare for the CPA exam? And what resources helped you?

CPA will provide the materials you will need in the modules.

Can you practice as an accountant if you do not have a CPA?

Yes you can, there are great accountants who do not have this qualification. Most senior management role requires this. I found out its like the minimum requirement in our field, but it is difficult to attain. With determination it is possible. Having a CPA just positions you better on the career ladder.

What are the job opportunities for Accountants in Canada?

I would say accountant are needed everywhere but the hurdle is getting the first job in your field once you can cross that the rest will come easy.

I personally do not agree with payscale/ glassdoor on salary expectations because I have earned and seen people earn more that what these websites suggested. Pay goes in the direction of value you are bringing so the range can go from $60,000/annum to as much as you want. lol

Are there any noteworthy aspects of Canadian accounting practice that you believe those considering the same career route you did should be aware of?

I found out Canadians are specialist, in Nigeria an accountant will do financial reporting, analyst, payable, receivable, tax and audit but here there are different people for each role, and it helps to focus even though it doesn’t build a well rounded accountant but who overworking epp lol.

What province is the best for Accountants?

I wouldn’t know this because I’ve only lived in two provinces, but I think accountants are needed anywhere money is earned and must be accounted for, whether it’s in the government, a private company, or an NGO.

What resources and support groups are available for Accountants?

The resources I have are mainly from the bodies I belong to CIMA and CPA. They share information on things happening in our world, seminars, conference etc.

What advice would you give wanted to those who want to be chartered accountants in Canada?

Visit the CPA website, get in touch with them, and write them an email if necessary so you can choose wisely. Additionally, when you begin it would seem like you are over reaching because most people don’t have it but fix your eyes on the prize. Here is CPA website to start https://www.cpaontario.ca/become-a-cpa/why-cpa/internationally-trained-accountants/member-of-accounting-body-outside-canada

post a comment

You must be logged in to post a comment.